Article contains Automatic Income Tax Calculator in Excel Format for Financial Year 2022-23 FY 22-23 ie. Allow MULTIPLE PERIOD for tax computation of partnerships business income.

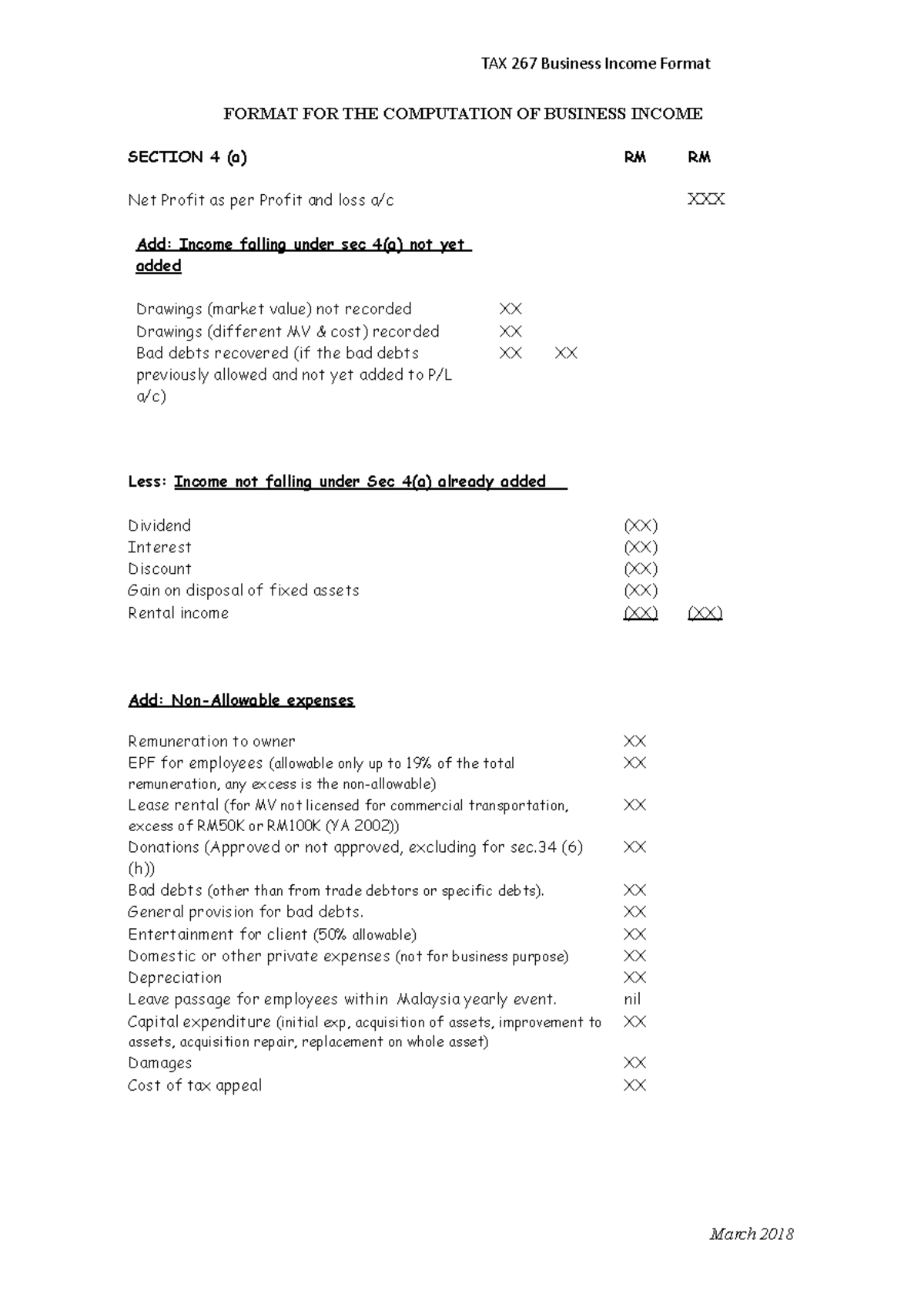

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

Attach a statement to your federal income tax return to show your computation of both the tax and interest for a nonqualified.

. Cross verify the names of the partners and their profit sharing ratios with that in the accounts of the current year and that of the previous year to ascertain any change. Calculate capital allowance balancing allowance and balance charge automatically. Tax rates for the years of assessment 201819 and 201920 are assumed to be the same and the one-off reduction of the.

Income Tax Assessment Year 2023-24. On a separate worksheet using the Form 100W format complete Form 100W Side 1 and Side 2 line 1 through line 17 without regard to line 14 Contributions. You may determine the amount of school district property tax paid on a parcel in the 2020 and 2021 calendar year by using the Nebraska Department of Revenues.

Partnership accounts capital account Lebogang Modise. Partnerships income is auto transferred to partners tax filing. The partners can claim the.

Computation of Penalty Due Based on Underpayment of Severance Estimated Tax. Partnership or S Corporation Tax Filing Booklet contains DR 0106 DR 0107 DR 0108 DR 0158-N DR 0106CR. Ppt ajay Vikas Panwar.

Disclose changes in the ratio. Income Tax Calculator is Useful. Income Tax administers individual income tax business privilege tax corporate income tax partnerships S-Corporation fiduciary and estate tax financial institution excise tax and withholding taxes for businesses and individuals.

If any federal charitable contribution deduction was taken in arriving at the amount entered on Side 1 line 1 enter that amount as a positive number on line 8. Company tax computation format 1 sakura rena. Income Tax Calculator is Useful.

Portfolio Management Final Yr Presentation Mothusi Lekgowe. A Pro forma Profits Tax Computation IR957 which is intended to assist owner of an unincorporated business who has not appointed a tax representative to submit a tax computation showing how the amount of Assessable ProfitsLoss has been arrived at can be obtained through the Fax-A-Form service Telephone No. Form 565 Partnership Return of Income is an information return.

Role of Private Equity In Successful Debt-to-Equity Conversion Ted Cominos Ted Cominos. Enter the adjusted basis of. Ratio for sharing losses if different from the profit sharing ratio should be disclosed.

Use this Form with the Forms noted below to claim the property tax credit. Illustrative examples of the application and computation of two-tiered profits tax rates. 402LTR 9901 Computation Schedule for Claiming License Tax Reduction for Approved New Business Facility Gross Receipts For Tax Periods beginning 01012006 700 Delaware Income Tax Credit Schedule.

If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. Verify Deed of Partnership for the names of the partners and their profit sharing ratios. 2598 6001 or from the Central.

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. Nebraska School District Property Tax Look-Up Tool. The income or loss reported on Form 565 flows through to the partners and is reported on their tax returns.

Tax Year Ending Computation of Penalty Due Based on Underpayment of Corporate Estimated Income Tax. A partnership has no tax liability except for the minimum tax paid by a limited partnership. Type of Nebraska Tax Return this Form is being Filed with 1040N 1041N 1065N 1120N 1120NF 1120-SN Part A Computation of the Credit Name on Tax Return Social Security Number or Nebraska ID Number Nebraska Property Tax Incentive Act Credit Computation.

Form 926 line 1 is new. The partnership will report your share of nonqualified withdrawals from a CCF. These withdrawals are taxed separately from your other gross income at the highest marginal ordinary income or capital gains tax rate.

Examples which illustrate the calculation of Profits Tax under the two-tiered profits tax rates regime and the comparison of tax payable under Personal Assessment. The withholding must follow the income and flow through to the partners. For transfers occurring after 2017 taxpayers are required to specify whether a reportable property transfer was to a foreign corporation that is a non-controlled specified 10-owned foreign corporation as defined in section 245A which was added to the Code by section 14101a of the Tax Cuts and Jobs Act TCJA PL.

The amount carried forward will be. 1100CR 0101 Computation Schedule for Claiming Delaware Economic Development Credits. The Nebraska Property Tax Incentive Act Credit Computation Form PTC is used to identify parcels and compute a tax credit for school district property tax paid.

Income for joint assessment is automatically transferred to primary tax payer. By Hand Valuation Timothy.

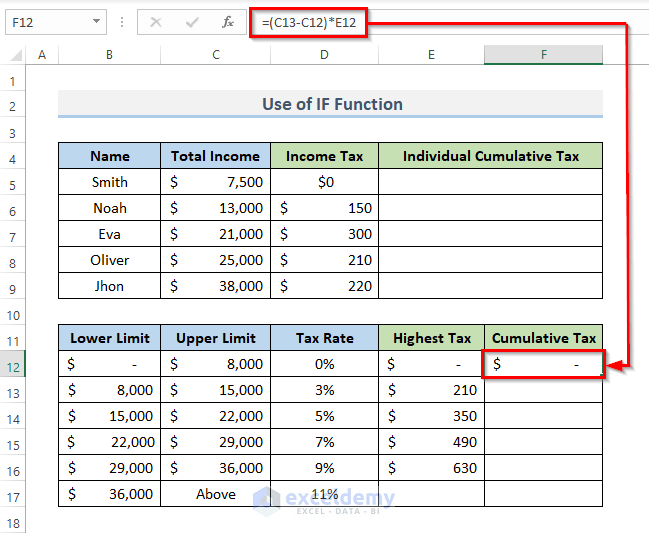

Computation Of Income Tax Format In Excel For Companies Exceldemy

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Ktps Consulting Partnership Tax Computation Facebook

Complying With New Schedules K 2 And K 3

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

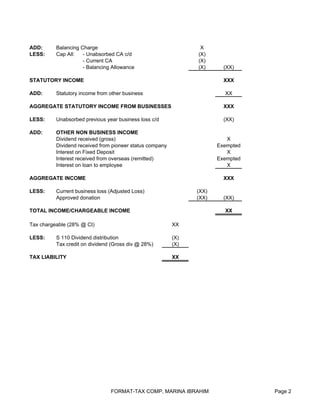

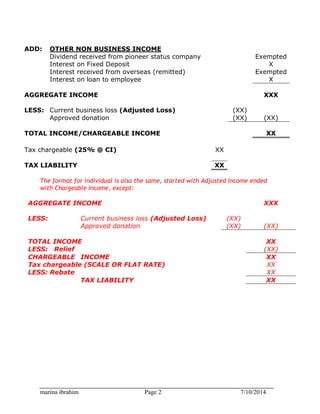

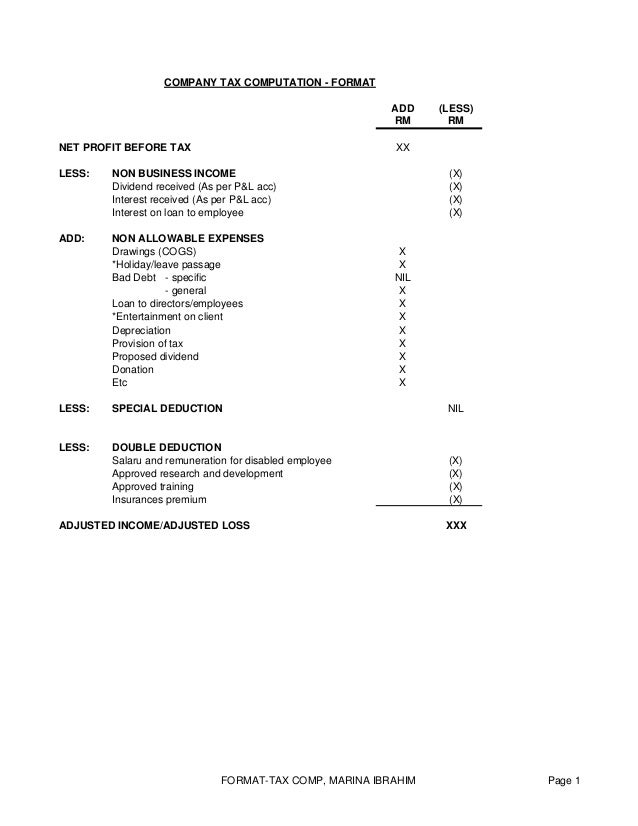

Company Tax Computation Format

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

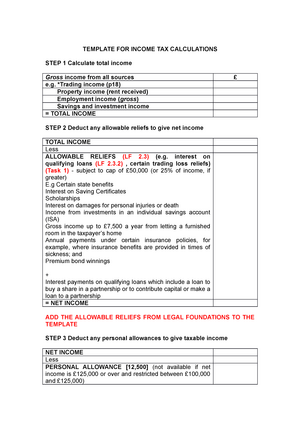

Template For Income Tax Calculations Template For Income Tax Calculations Step 1 Calculate Total Studocu

Single Step Vs Multi Step Income Statement Key Differences For Small Business Accounting

Company Tax Computation Format 1

Question 1 Partnership Firm Taxation A Partnership I

Ktps Consulting Partnership Tax Computation For Reference Only Facebook

Income Tax Basic Concepts A Comprehensive Guide Tax2win

Company Tax Computation Format

Company Tax Computation Format 1